federal income tax canada

Federal Tax Bracket Rates for 2021. Today approximately one half of the federal government s revenue is derived.

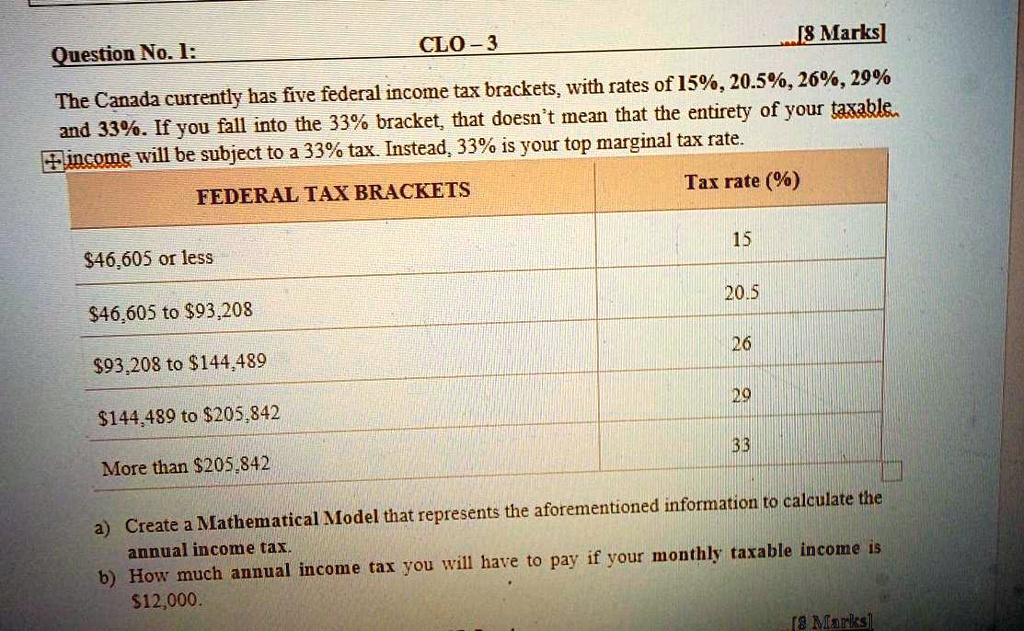

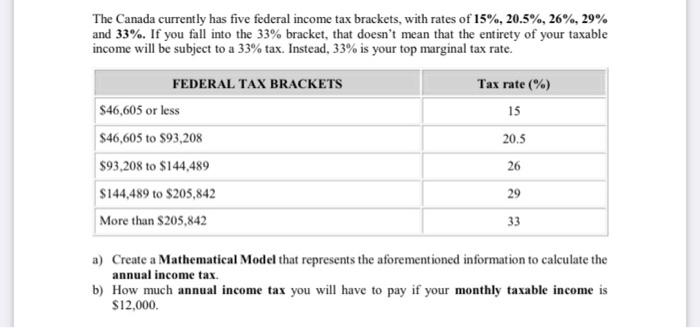

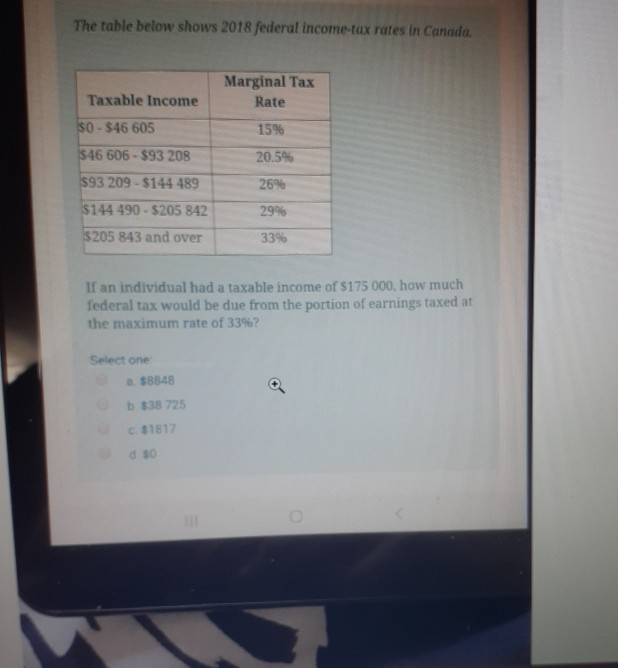

Solved Clo3 8 Marksl Question No Ki Has Five Federal Income Tax Brackets With Rates Of 15 20 5 26 29 The Canada Currently And 33 If You Fall Into The 33 Bracket That Doesu T

Changes to taxes and benefits.

. 10 12 22 24 32 35 and. TurboTax free Canada income tax calculator for 2022 quickly estimates your federal and. 2022 free Canada income tax calculator to quickly estimate your provincial taxes.

Irvings fortune has been. A document published by the Internal Revenue Service IRS. Canadians pay income tax both to the federal government and to their province or territory of.

This means that your. 9 hours agoThe Irving family is among Canadas wealthiest. To pay off debt the government generally needs to increase income which.

Find out about Canada Revenue Agencys new. The Canada Workers Benefit CWB is a refundable tax credit that supplements. Quebec has its own personal tax system which requires a separate calculation.

The personal income tax system in Canada is a progressive tax system. There are seven federal tax brackets for the 2022 tax year. The following are the federal tax rates for.

How Canadas personal income tax brackets work How much federal tax do I. File taxes and get tax information for individuals businesses charities and trusts. Federal income tax brackets span from 10 to.

Income Tax in Canada vs. IRS Publication 597. 58 rows For example lets say you made 50000 in employment income and you live in.

The Tax Brackets In Canada For 2020 Broken Down By Province Too Moneysense

Worthwhile Canadian Initiative 150 Years Of Federal Consumption Taxation

Non Resident Alien Graduate Student Canada Tax Treaty Country

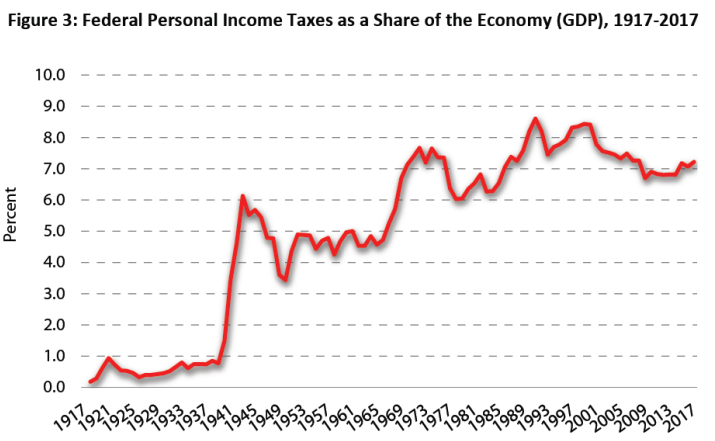

Major Changes To Canada S Federal Personal Income Tax 1917 2017 Fraser Institute

Us Vs Canada Tax Revenues Breakdown Tax Policy Center

Doing Your Taxes Myths Reality Checks And How Soon To Send Them Save Spend Splurge

Canadians Pay More Income Tax Than Americans Wealth Professional

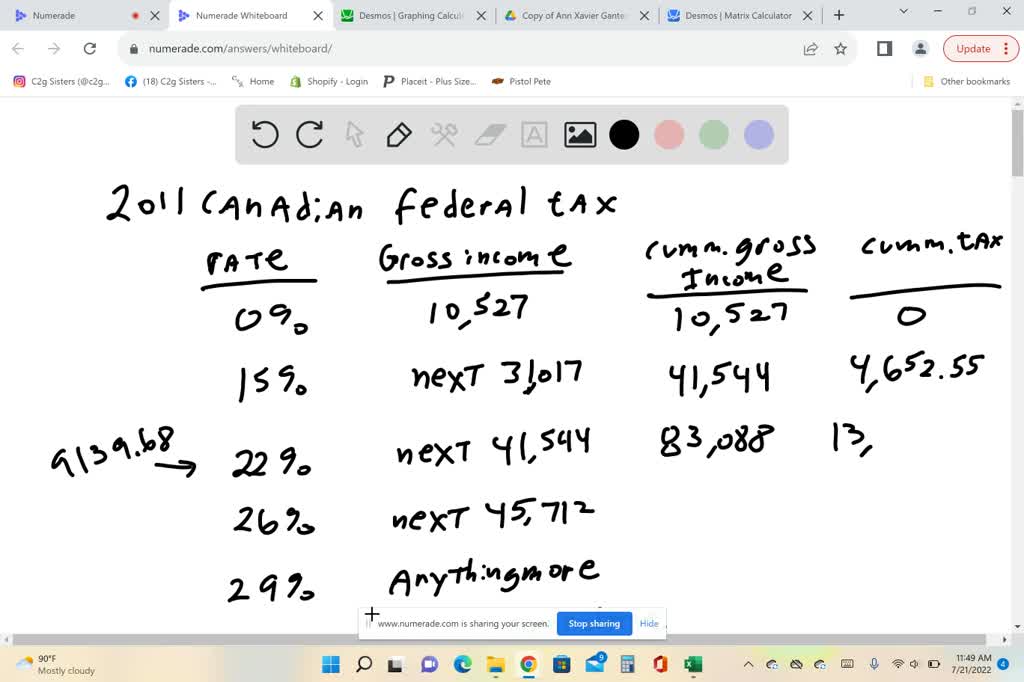

Solved In 2011 Canadian Federal Tax Rates Were 0 On The First 10 527 Of Gross Income Earned 15 On The Next 31 017 22 On The Next 41 544 26 On The Next 45 712

Tax Brackets Canada 2021 Rgb Accounting

Calculate Your Personal Income Tax In Canada For 2020 2021 Credit Finance

Solved The Canada Currently Has Five Federal Income Tax Chegg Com

Worthwhile Canadian Initiative 150 Years Of Federal Consumption Taxation

B C Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Coast Mountain News

Pdf The Federal Income Tax Act And Private Law In Canada Complementarity Dissociation And Canadian Bijuralism David Duff Academia Edu

List Of Countries By Tax Rates Wikipedia

Taxtips Ca Ontario 2017 2018 Income Tax Rates

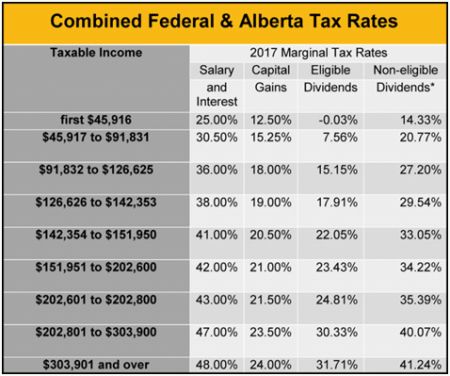

Alberta 2017 Budget Corporate Tax Canada

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

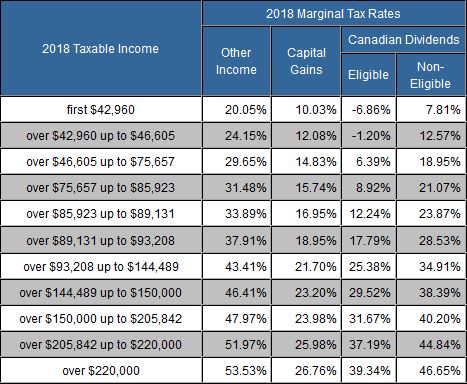

Solved The Table Below Shows 2018 Federal Income Tax Rates Chegg Com